Weekly DeFi Index

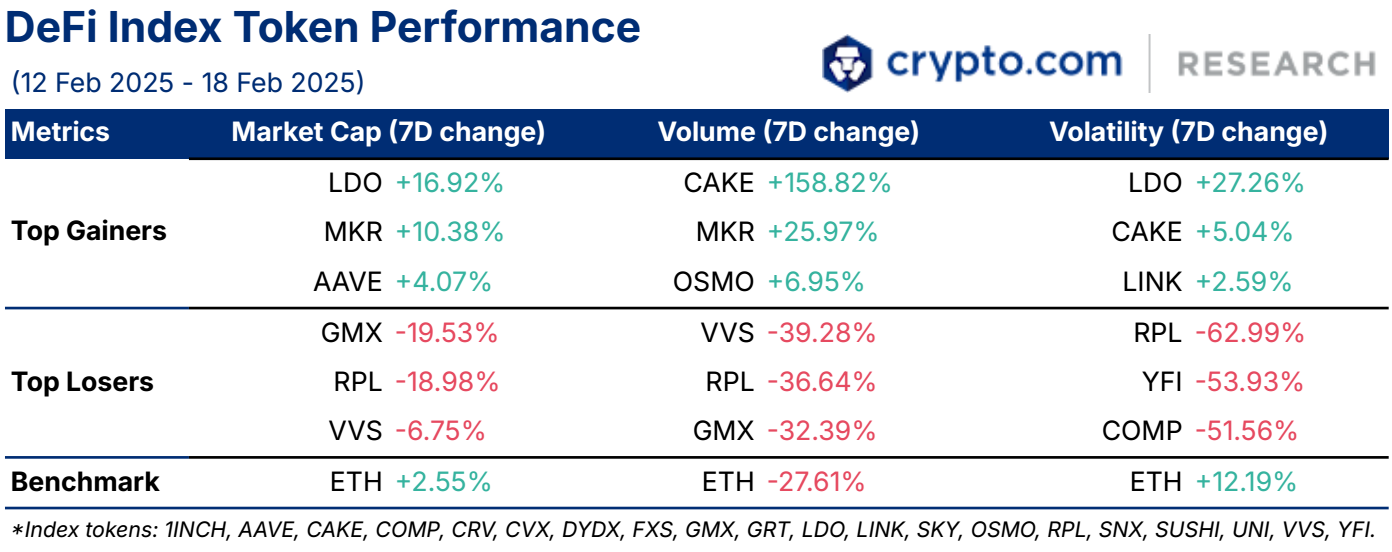

This week, the market capitalisation and volatility indices dropped by –3.89% and -4.76%, respectively, while the volume index increased slightly by +1.32%.

Chart of the Week

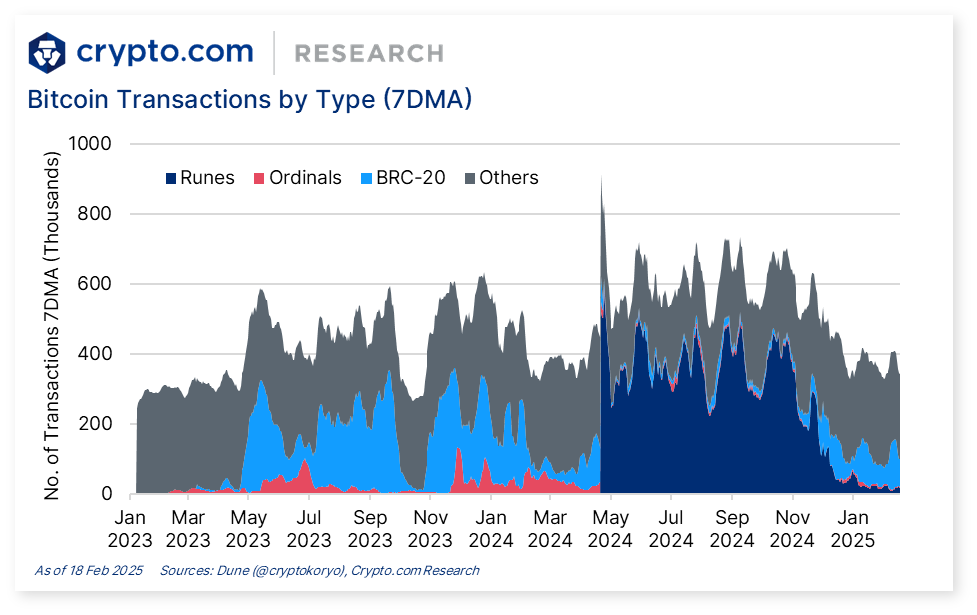

The 7-day moving average (7DMA) of Bitcoin network transactions declined to 333,000, a 64% decrease from its peak of 927,000 transactions, according to data from Dune. Daily transaction fees have stabilised around US$500,000, down from higher levels seen at the end of 2024.

The decline is attributed to a shift in network utilisation, with Bitcoin-based protocols like Runes, Ordinals, and BRC-20 accounting for around 30% of total transactions. Market dynamics have shifted towards other blockchain ecosystems, such as Solana, capturing specific on-chain niches and trading volumes.

News Highlights

- The Ethereum Foundation allocated 45,000 ETH, valued at approximately $120 million, across four DeFi protocols, namely Aave Prime, Aave Core, Spark, and Compound. Despite criticising the Foundation’s management of its ETH holdings and operational costs, the community has reacted positively to this allocation, viewing it as a significant step towards deeper DeFi engagement.

- Standard Chartered, Animoca Brands, and HKT established a joint venture to issue a Hong Kong Dollar-backed stablecoin. The entity aims to apply for a licence from the Hong Kong Monetary Authority (HKMA) to tap into the growing digital asset ecosystem locally.

- Hyperliquid launched HyperEVM, an ecosystem component that integrates an Ethereum Virtual Machine (EVM) into its Layer-1 (L1) blockchain. This allows developers to run Ethereum-compatible smart contracts with enhanced performance.

- Solana improved the network’s incentive structure and transaction processing by implementing a proposal to pay full priority fees to validators. By paying higher fees for priority processing, the initiative seeks to boost network efficiency and attract more validators to the blockchain.

- Ethereum-based lending platform Liquity Protocolexperienced $30 million in outflows following the disclosure of a bug in its V2 upgrade. The announcement raised concerns among users, leading to a significant withdrawal of assets from the platform.

Recent Research Reports

|  |  |

|---|---|---|

From Trading to Broader Adoption: The Significance of Meme Coins |

| |

|---|---|

| |

| From Trading to Broader Adoption: The Significance of Meme Coins |

Research Roundup Newsletter [Jan 2025]: We present to you our latest issue of Research Roundup, featuring our deep dives into The Significance of Meme Coins and DeFAI.

DeFAI: DeFi x AI: DeFi is witnessing a fresh wave of innovation, with one of the most exciting developments being the fusion of DeFi and AI — often referred to as DeFAI. In this report, we look into the DeFAI landscape, and delve into Griffain and HeyAnon as case studies, both of which are notable examples in the abstraction protocol category.

From Trading to Broader Adoption: The Significance of Meme Coins: The launch of US President Donald Trump and his wife Melania’s meme coins, — $TRUMP and $MELANIA, — drove the meme coin hype to a new level. Meme coins are going beyond acting as an investment vehicle and becoming tools for community engagement, capital raising, and user acquisition.

Recent University Articles

|  |  |

|---|---|---|

Will Quantum Computing Threaten Bitcoin and Cryptocurrency Security? | Polkadot vs. Avalanche – Comparing Two Leading Multichain Protocols |

| |

|---|---|

| Will Quantum Computing Threaten Bitcoin and Cryptocurrency Security? |

| Polkadot vs. Avalanche – Comparing Two Leading Multichain Protocols |

4 AI Agent Tokens to Watch in 2025: Discover four of the most popular AI agent crypto tokens to watch in 2025, blending cutting-edge blockchain and artificial intelligence technology.

Will Quantum Computing Threaten Bitcoin and Cryptocurrency Security?: Explore the potential impact of quantum computing on Bitcoin and cryptocurrency security.

Polkadot vs. Avalanche – Comparing Two Leading Multichain Protocols: Dive into the multichain world of Polkadot vs. Avalanche, comparing their unique approaches to scalability, governance, and ecosystem development in the blockchain space.

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Authors

Research and Insights Team

Get the latest market, DeFi & NFT updates delivered to your inbox:

Be the first to hear about new insights:

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.